Post Seed Purgatory

In the past 12 months, the public markets are a sea of red. While the S&P500 is “only” down 17% this year, the Nasdaq is down 30%. Tech stocks have been the hardest hit. Even the esteemed FAANGs have not been spared. Apple, the darling of the public markets (and Warren Buffett’s tech stock of choice) is down 16% this year and others like Meta (Facebook) are much worse (down 66%).

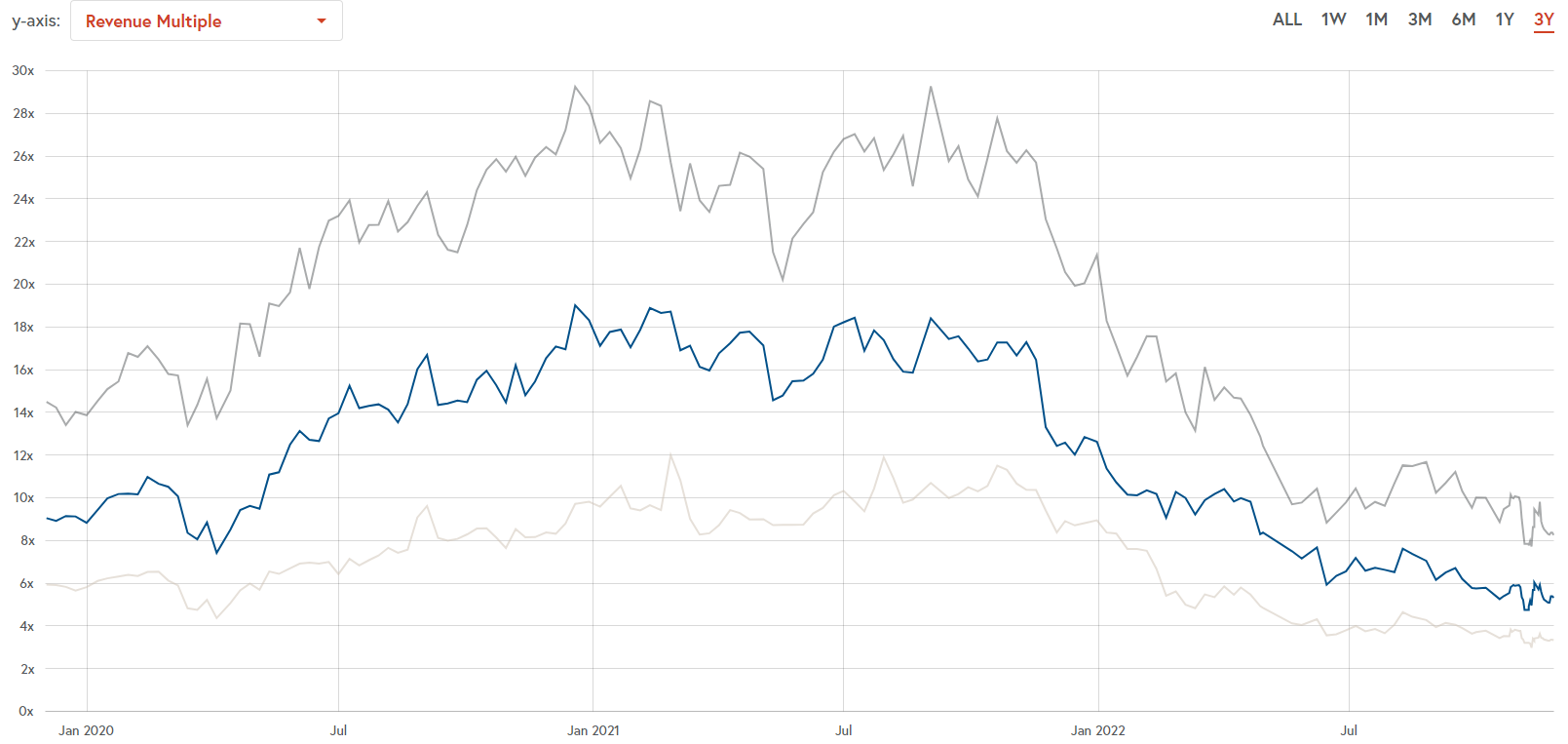

The Bessemer Emerging Cloud Index that tracks the top SaaS companies is down 56%. As a result, median SaaS revenue multiples have sharply declined. From a high of 18.43x in September 2021 to 5.3x in November 2022.

In venture capital, we are seeing the effects of this public market rout. Pathways to exit have been severely hampered - IPO volume is down 81% and IPO proceeds are down 95% from a year ago. Companies are hesitant to go public amidst this market correction where public market multiples are significantly lower than their highs in 2020 and 2021. Seeing exit opportunities in the public markets dry up, late stage investors are tightening their belts as well. QoQ volume for Series C companies declined by 52% and dollars raised declined by 80%.

This late stage contraction, then has a waterfall effect upstream in the venture market. Series A valuations have declined 30-35% while seed valuations are down only 6%. Only 80% of early stage rounds were “up” rounds compared to 94% in Q2 2022. With VCs tightening up, size of seed rounds have declined 58% from their highs in Q1, Series A round sizes are down 65% and Series B rounds are down 76%.

Whew, that's a lot of data, but what does it mean?

This combination of late stage market contraction and sharp decline in multiple comps for tech companies creates a Post Seed Purgatory for early stage startups that raised their seed rounds in the last 12-18 months and are expecting to raise their Series A / B in the next 24 months. Companies have raised money at relatively high valuations compared to their revenue progress. Now, they will have to show significant progress to raise their next round at an appropriately increased valuation, but since multiples have compressed, growth needs to be faster than the rate of multiple compression.

Here's a super simplified example. Let's say a hot new seed startup Purgatory Inc. has $5M of revenue and previously raised a round on a $100M valuation. They are in-market trying to raise a growth round at a $200M valuation. 12-18 months ago, when SaaS multiples were hovering in the 18-20x range, growth stage investors would value Purgatory at $200M if their revenue grows to $10M - $11M which requires 100% revenue growth from their last round. However, in this market, growth investors need ~$40M of revenue to value a company at $200M. Revenue needs to grow ~700% in case.

This vicious cycle of valuations starts with public markets. Most growth stage VCs I know are shifting their own prices to match public market comps because they know that they must exit their investment in the public market. Based on the math above, if they don’t adjust their entry price to match expected exit multiples, the investment becomes MUCH riskier. Relatively easier to underwrite 100% growth to get a 2x on their investment, than 700% growth for the same multiple.

This logic slowly cascades down to earlier stage investments. As later stage investors tighten their belts on valuations, earlier stage VCs investing in companies that will eventually need to raise money from later stage VCs must accordingly adjust their own earlier stage rounds to account for this multiple compression. As markets continue on their current trajectory, even earlier stage VCs will begin to offer more conservative valuations, creating this Post-Seed Purgatory.

How to navigate fundraising in the next 6-12 months

First, I am expecting longer fundraising cycles as VCs evaluate market conditions to re-calibrate investment strategy. Rounds that might have taken 30 days to subscribe might take 2-3 months (or more). Give yourself a buffer. Don’t wait until you only have a few months of runway to fundraise.

Second, I am recommending my portfolio companies to run flexible, agile fundraising processes. In a tight, cash-poor environment, optimize your process to get money in the bank as quickly as possible. Might take a slightly lower valuation than you were targeting. Maybe a smaller bridge round. Better to be alive and growing at a lower valuation than to aim too rigidly for a high valuation and die.

Third, cut burn and extend runway to reduce dependence on an external fundraise. The more you can stretch the dollars already in the bank, the more flexibility in fundraising conversations with investors.

I didn’t write this because I am overly bearish. I am not pressing the panic button. You shouldn’t either. Phenomenal companies continue to grow, raise money and exit. Some of the best companies have been built and scaled in times like these. I am writing this to share this data, and my perspective, to help early stage founders better understand and navigate fundraising in this market.